Inflation since 1950 - 988%. This was when my dad graduated high school and went into the work force full time. He is now in his 80s and has to cope with the increase in costs yearly on his social security checks. My mother was a teacher and gets a retirement check through the state of Texas for her 31 years of service. Together, they make about $3,500/month. Lots of things come into play here though. Both of them had to survive and it takes both of their incomes for them to live independently. If either of them passes away, the income is cut in half and would not be enough to make it on their own. They've been lucky in that regard. Many, if not most, of their friends have lost their partner at this point in life.

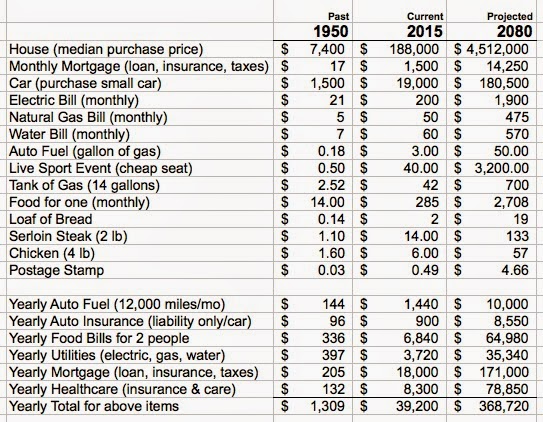

I wanted to see what it was going to be like for my girls, who are just now graduating and going into the workforce. What are they going to be facing if they live as long as their grandparents? I've worked up the following spreadsheet with costs from the past, present and projected future. It's staggering. If you don't believe the numbers, you're just flat in denial. Those who ignore the past are doomed to repeat it. Ask your parents and grandparents how it feels to live with our current prices - food, healthcare, cars, houses, utilities, etc. They will confirm. They could not have comprehended what was going to happen from the time that they were children to now. Why would it be any different for us. Dad still talks about being able to go out on a date for 25¢. It's about $50 now. What do you think it will cost 60 years from now!? Look at the numbers below with an open mind and an open heart. Think about your prospect to deal with housing, food, healthcare and transportation costs if we keep going down the path we've been following. Let's learn something here!

I've talked about cognitive dissidence before. The ability to hold onto two opposing/conflicting ideas at the same time. Yes, it happened in the past. No, it could never happen again, especially to me! This is Exactly why we're pushing so hard to get out of the rat race! Stop giving all of our money to someone else. We need to economize and plan for the inevitable. Prices are going to keep rising. That's the only way the country can keep up with the global economy that we've created. We could put a freeze on all monetary values - income and expenses, and we would no longer have to deal with inflation. That means though that our incomes could never go up but all of the things we get from around the world would continue to rise. We would be stuck in a 2014 economy while the global economics would wash over us. You would never be able to afford to buy anything that was imported or go out of country for travel - business or pleasure.

Think about a couple of economic models that interact right now. Japan and Mexico. We love to go to Mexico for vacation (when we can find some place that's safe) but we rarely consider Japan. Why!? Well, it's $50/night for a room and meals in Mexico City and $500/night in Tokyo. Average worker in Mexico gets about $80/week. Average worker in Japan gets about $1200/week. How many Mexicans do you think go to Japan for vacation if they have to spend 6 weeks salary per night to stay? On the other hand, someone from Japan can stay for about 10 days in Mexico for one day's work. That's why we can't put a freeze on our economy here. We would end up where Mexico is before long.

You have to accept the obvious, that which is in black and white in front of you, prices for everything are going to continue to rise. Our problem as Baby Boomers is that we'll soon be leaving the work force. This means no more opportunity for promotions or raises in income. We will soon enter the "Fixed Income" amusement park where we have a fixed income to spend each month but the rides and food keep getting more expensive every hour that you're there. I can't tell you how many of my contemporaries I talk to that don't see it coming, don't want to see it coming, don't want to talk about it. There aren't enough greeter jobs at Walmart to employ all of us when we hit our 70s and who wants to stand in front of a windy door on concrete all day for minimum wage. All because we 1) didn't plan ahead, 2) thought that somehow, someone was going to step in and take care of us, 3) ignored all of the evidence of the past.

I don't mean to make this a sermon about our wasted years through the 80s and 90s. I just want to confirm why it's imperative that we take dramatic steps to head off this bulldozer, before it has a chance to bury us. Get you housing costs under control. This means mortgage, taxes, insurance, utilities and upkeep! Get your vehicle expenses down to the bare minimum. Learn to grow some of your own food. I'm not saying you have to become a farmer. Just put in a small garden to start with and learn how to take care of it. Get your weight and health under control. This can dramatically help your healthcare costs. You have control over all of this! No one is making you pay for that McMansion and the HOA fees. No one is making you go out to eat every night. No one is making you drive 2 new cars. Find out what you can do about your situation and plan for the future instead of letting it dictate what you must do.

None of us want to be working when we're 75 years old. Just to pay our rent, utilities and food. Go over the numbers above and try to figure out where you fit into that world. Try to set an example for your children and grandchildren of how to plan for the future. This Tiny House lifestyle isn't for everyone. There are lots of people that would gladly work long hours until they are well into their 70s and 80s for the opportunity to give their hard earned money to someone else so that they have a separate bedroom, game room, office, living room and kitchen. Me, for one, I'm willing to live in a smaller space with a common bedroom, living room, office and kitchen so that I don't. Don't have to give 10s of thousands of dollars away each year to someone else. Don't have to pay high taxes, insurance and utilities to support that lifestyle. Don't have to work until I'm so old that I can't enjoy the last ⅓ of my life. Make those hard choices to benefit your own life, your own dream, not financially support someone else's. Bless you all!

Hi there~ I was referred over from one of the tiny house sites; I'd love to read more of your blog, you've got a lot of good things to say but the font and black background, as well as the lack of more 'space' meaning more often paragraphing things makes it hard on the eyes. Just a thought; thanks. :)

ReplyDeleteThanks for the input. I ran it by the boss (the wife) and she agreed. The white text was difficult to read. I really appreciate the suggestion. Sorry if I get long winded sometimes. I do tend to ramble and often stray off track! :) Any thoughts on the the blog subjects would be welcomed.

DeleteJay

have you considered including the increases in income for the various times? Minimum wage, skilled (mechanic, plumber), professional (doctor, lawyer)? just for completeness.

ReplyDeletebut thanks for the heads-up!

Appreciate the feedback! :) Agreed, incomes will rise along with expenses. They will be making ridiculous money but most agree that those increases flatten or actually dip after someone reaches 50 years old, so most of us will never see them. Rare to see people in their late 50s and 60s getting promotions and raises. They typically plateau on income and then watch as all of their expenses continue to climb for the next 30 years. My Grandmother's SS income ($500/mo) was enough for her when she retired at 65 but by the time she was 85 (it was now $600/mo), she was struggling just to pay the utilities and food bills. Best to assume it will be out of control as we get older and try to plan for living frugally. Our first and biggest step will be getting rid of as much of our housing expenses as possible. My daughter is mad at me now because I made her start an IRA when she was a Freshman in High School. She now has to invest 20% of all income. I asked to to survey everyone in every class she had. How many were already planning for retirement? Answer was "NONE". Lots of them working. Lots of them spending everything they made. Some of them saving for short term goals, namely cars. None of them saving anything for the long term. I hope she does a better job than I did and stays the course when I no longer have a say in her affairs. :) She has a niece that credit me with her good financial planning because I had the conversions with her every time we were together for years. She's be able to retire in her 40s if she keeps working at her current pace. I'll look at putting together some charts on income increases to include as well. Thanks again! - Jay

ReplyDeleteThis is a very eye-opening post; however, if you live in California as I do, the above numbers are a bit low. For instance, housing - a 1 bedroom apartment is in the neighborhood of $2000 and up. The average cost of a 3 bedroom 2 bath home with a meager 1500sf is averaging $650,000 on a good day. If you are in high tech, as my husband WAS, and are the recipient of a layoff, chances are you may experience extended unemployment. In my husband's case, he was 62 when his company released 50 people from a steady paycheck and health insurance benefits. He's now 64, has applied to 140 jobs and we have moved in with my 91 year old mother because out $3000/mo rental sucked us dry.

ReplyDeleteI've been researching tiny houses for over 2 years. What I've learned so far - I can't afford to live in my home state, and I can't afford to move. I have no idea how to dig myself out of this quicksand. Even if I could afford to buy or build a tiny house, there is no place to park one.

Yeah, life is not so great for this 62 year old who gets $849/mo social security. And when the news reports of 500,000 refugees coming to the United States, I'm at a loss for anything resembling comprehension.

Sorry to hear that things aren't going smoothly. This past 5-10 years has been a wake-up for a lot of us. My wife was out of work for about a year. Finally hired back on with a company with a 30% pay cut. It's tough. My only advice would be to get out of California. Don't know how you could possibly get ahead there. Would your mother-in-law be willing to move also? She could sell her property and improve her situation significantly by moving to Texas also. It's not as charming as California but a lot more affordable. We purchased our land for about $5K per acre here outside of Dallas. No restrictions on building size or materials when you're outside of most city limits. Purchase a used RV trailer and stay in it while you build something more permanent. We've taken over 2 years to get to where we are on our Tiny House - BUT - we will owe nothing on it when we're done, our utilities are about $50/mo and our taxes will be about $30/mo. It will be a great chance for us to make up for all of the financial mistakes we've made along the way. :) Set your determination meter to "HIGH" and get after it! If you don't look out for your future, no one will. Best of luck!! Let me know when you land in Texas and we'll open a bottle (or 3) of California wine to celebrate your freedom!! :)

ReplyDelete